PRIMARY CONCEPTS

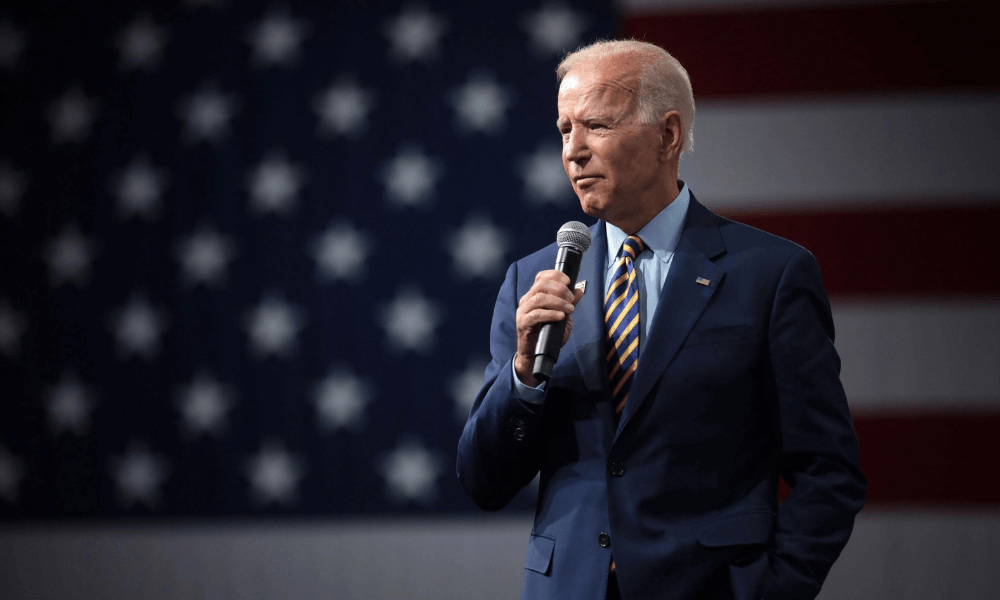

President Joe Biden said on Wednesday that he supports Federal Reserve Chairman Jerome Powell's expected decision to begin tightening monetary policy and phase out the easy-money policies that the central bank adopted to protect the economy from the Covid-19 outbreak.

Biden said he respects the Fed's independence but that the central bank's job is to keep inflation under control.

"Covid-19 has caused a slew of economic issues, including sharp price rises around the world. "It's seen at the petrol pump, in grocery shops, and everywhere else," Biden stated at his first press conference of the year.

"For the prior year and a half, the Federal Reserve gave remarkable help during the crisis," the president added. "Given our economy's strength and the rate of recent price increases, it's time — as Fed Chairman Powell has suggested — to readjust the assistance that is now required."

While Biden's remarks were brief and complimentary, they were noteworthy given that the Fed, as a nonpartisan agency, has the authority to maximize employment and keep prices in check.

Former President Donald Trump broke with historical precedence when he publicly chastised the Fed's decision-making and previous efforts to make borrowing more difficult. Trump's jabs were frequently personal, and he frequently mocked Powell as Fed chairman. In 2017, Trump selected Powell, a Republican, to lead the Federal Reserve.

Powell was nominated for a second term by Biden late last year, in part because of the Fed chairman's efforts to protect American businesses and financial institutions amid the worst of the coronavirus pandemic.

For months, the central bank has hinted that interest rates will be raised soon, and it has already begun to reduce the amount of Treasury bonds and mortgage-backed securities it buys each month to boost the US economy. The moves are intended to increase the cost of borrowing for American businesses and reduce their appetite for debt.

| 👉🏽 Top News: Treasury Yields Hit New Highs, Sending Asian Stocks Lower |

In recent months, the Biden administration and the Federal Reserve have both come under fire from disgruntled voters due to rising inflation and rising prices for products as diverse as meat and used vehicles.

According to the latest inflation report from the Labor Department, consumers in the United States paid 7% more for all goods and services in December than they did a year ago. This was the most rapid year-over-year price increase since 1982.

According to the theory, businesses will not spend as much if they can't borrow as much, and overall economic activity will slow. Inflation indicates an overheating economy and a sign that supply and demand are out of balance.

Democrats and the majority of economists blame the present inflationary wave on the global pandemic. According to experts, it will calm down after supply chain issues are handled.

Other economic indicators point to a more optimistic prognosis for the US economy. The White House released a set of records linked to the U.S. job market and the improvements that American workers saw in 2021 earlier on Wednesday.

According to the most recent Labor Department figures, the United States added a record number of jobs in 2022, increasing more than 6 million. Meanwhile, the jobless rate in the United States fell from 6.2 percent when the president took office to 3.9 percent in December, the highest one-year decline in history.