Concise:

Report Reuters - WASHINGTON, Jan12 - Consumer prices in the United States rose steadily in December, with substantial gains in rental housing and used automobiles, resulting in the most significant annual increase in inflation in nearly four decades, bolstering anticipation that the Federal Reserve may begin hiking interest rates as soon as March.

The Job Department's report came in the wake of data released last Friday that showed the labor market was at or near full employment.

In testimony before the Senate Banking Committee on Tuesday, Fed Chair Jerome Powell said the bank was ready to do whatever it took to keep high inflation from getting "entrenched." Powell is seeking re-election to a second four-year term as the bank's chairman.

The high cost of living caused by clogged supply chains due to the COVID-19 pandemic is a political disaster for President Joe Biden, whose approval rating has plummeted.

"The Fed will be forced to start raising rates in March, and depending on political pressure from both sides of the aisle, they will have to raise rates four or more times this year, and possibly more next year," said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance in Charlotte, North Carolina.

After increasing by 0.8% in November, the consumer price index increased by 0.5% last month. Consumers paid more for food in addition to increased rents, though the 0.5% increase was less than in the previous three months. Fruit and vegetable prices rose significantly, although meat prices declined 2.0% after recent high increases.

Consumers also received a break from growing gasoline costs, which dipped 0.5 percent in November and October after jumping 6.1 percent in November and October.

The CPI increased by 7.0 percent in the year ending in December. Following a 6.8% gain in November, the most significant year-over-year increase since June 1982.

Inflation is hurting wage gains as well. In December, inflation-adjusted average weekly wages declined 2.3 percent year over year. The inflation readings from last month were in line with predictions.

As the global economy recovers from the pandemic, President Biden stated practical every country is experiencing inflation.

"This study demonstrates that we still have work to do," Biden said in a statement, "with price hikes that are still too high and pinching family budgets."

Inflation is significantly above the Fed's accommodative objective of 2%. As the labor market tightens, emerging wage pressures are also being boosted. In December, the jobless rate hit a 22-month low of 3.9 percent. According to CME's FedWatch tool, markets have priced in an 80% chance of a rate hike in March.

According to economists, the Fed officials were caught off guard by the broad extent of inflation. There are fears that inflation expectations may become entrenched, forcing the Fed to tighten monetary policy aggressively, potentially triggering a recession.

"This is the first time since the 1980s that the Fed has chased rather than tried to prevent nonexistent inflation," said Diane Swonk, chief economist at Grant Thornton in Chicago. "Prepare yourself."

Stocks on Wall Street were trading higher on Friday, as investors were relieved that the price increase was as planned. The value of the dollar dropped versus a basket of currencies. The price of US Treasury bonds increased.

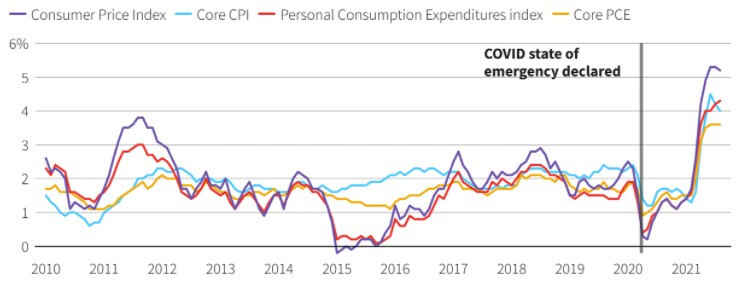

The COVID inflation surge

The U.S.A government produces two main inflation measures and "core" variations that exclude some more volatile goods. All have risen faster and more presistently than the Fed expected.

Source: Bureau of Economic Analysis, St. Louis Reserve

Graph Reuters

Easing Bottlenecks

Economists expect the CPI rate on a year-over-year basis to peak in December or will do so by March. According to a poll released last week by the Institute for Supply Management, there are hints that supply bottlenecks are starting to alleviate, which found that manufacturers reported improved supplier deliveries in December.

However, rising COVID-19 infections, fueled by the Omicron strain, may impede supply chain normalization.

The CPI grew 0.6% last month after climbing 0.5 percent in November, excluding the volatile food and energy components.

Rents increased the core CPI for the third month in a row, with owners' equivalent rent of primary dwelling, which is what a homeowner would get from renting a home, climbing 0.4%.

After gaining 2.5% in each of the previous two months, used car and truck prices surged by 3.5%. The surge is most likely a result of Hurricane Ida, which hit in late August and early September and wrecked thousands of cars and other items.

New car costs increased by 1.0%, marking the ninth month in a row of advances. A global semiconductor scarcity has hampered the production of automobiles.

Furniture, bedding, and housekeeping supplies have all increased in price. Apparel prices increased by 1.7 percent, the most since January 2021. Healthcare costs increased by 0.3 percent.

Prices for airplane tickets, personal care goods, and tobacco have also increased. However, both the cost of motor vehicle insurance and amusement decreased. The cost of communication remained unchanged.

The so-called core CPI increased by 5.5 percent in the 12 months leading up to December. Following a 4.9 percent growth in November, this was the highest year-over-year gain since February 1991. The core CPI rate is expected to peak in February this year.

Nonetheless, inflation is expected to remain above the 2% target this year.

"Inflation will moderate in 2022 when supply chains reopen and prices for some products, such as autos and energy, fall as supply catches up to demand," said Gus Faucher, chief economist at PNC Financial in Pittsburgh.

"However, due to increasing labor costs and input prices, inflation for many other goods and services will be higher in 2022 than before the epidemic. Inflation will be strong in 2022 as a result of housing."