Repayments to creditors by poor countries are at their highest level in two decades.

Fears are increasing that the US central bank's action to contain high inflation will spark a new debt crisis after it was revealed that poor-country loan repayments are already at their highest level in two decades.

According to the Jubilee Debt Campaign, debt payments by developing countries have more than doubled since 2010. They are projected to rise even more if the Federal Reserve raises interest rates as planned.

The JDC, which is pushing for more debt relief, claims that payments to creditors would account for 14.3% of poor-country government revenue in 2021, up from 6.8% in 2010 and the highest level since 2001.

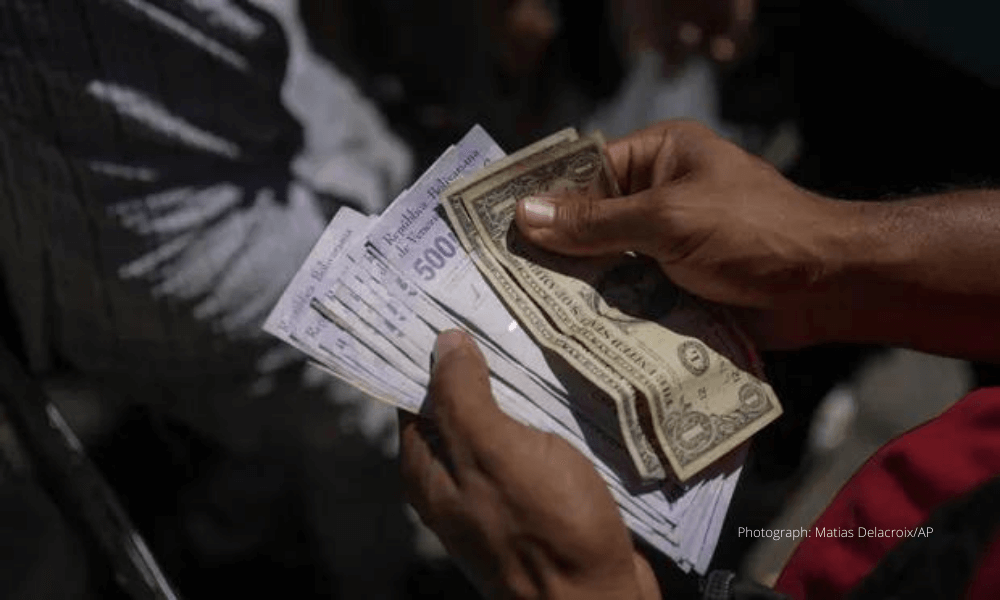

Many impoverished countries have borrowed in US dollars, putting them at risk of rising borrowing costs as well as currency depreciation.

More comprehensive help has been sought by the World Bank and the International Monetary Fund. Low- and lower-middle-income countries pay 47% of their foreign debt to private lenders, 27% to multilateral institutions, including the World Bank and the IMF, 12% to China, and 14% to governments other than China.

"The debt crisis has already stripped governments of the resources needed to face the climate emergency and the continuous disruption from Covid," said Heidi Chow, executive director of Jubilee Debt Campaign. "Rising interest rates threaten to sink countries even further into debt."

According to the campaign group's most recent analysis, 54 countries were in a debt crisis, which is defined as a situation in which a government's capacity to guarantee its citizens' fundamental economic and social rights is harmed by payments. According to the report, Kenya and Malawi were among the countries added to the list of countries in crisis.

"The G20 leaders cannot continue to bury their heads in the sand and hope that the debt problem would go away," Chow added. "A comprehensive debt cancellation plan that compels private lenders to participate in debt reduction is urgently needed."