It's been 30 years since 10-year Treasury yields have risen this much to begin a year.

So far in 2022, bond rates are climbing again. The stock market in the United States appears to be vulnerable to a genuine downturn. But how much can you tell just two weeks into a new year? There isn't much yet a lot at the same time.

One thing is certain: the days of easy money in the epidemic age are ended. Bond yields, which have been held at historically low levels, are set to climb in lockstep with benchmark interest rates.

The Federal Reserve members didn't seem to be able to make that point any clearer this week, ahead of the typical media blackout that precedes the central bank's first policy meeting of the year on January 25-26.

The market's expectations of a more aggressive or hawkish monetary policy from the Fed have been reinforced by the release of consumer and producer price indexes in the United States this week.

The only genuine issue is how many rate hikes the Federal Open Market Committee will deliver in 2022. JPMorgan Chase & Co. JPM CEO Jamie Dimon hinted that seven might be the number to surpass, with market-based predictions pointing to three federal-funds rate hikes in the coming months.

Meanwhile, 10-year Treasury note rates were 1.771 percent on Friday afternoon, according to Dow Jones Market Data, which implies that yields have risen by nearly 26 basis points in the first 10 trading days of a calendar year, which would be the fastest such rise since 1992. To begin the year 30 years ago, the 10-year note climbed 32 basis points to roughly 7%.

According to FactSet data, the 2-year note BX:TMUBMUSD02Y, which is more sensitive to Fed interest rate adjustments, is knocking on the door of 1%, up 24 basis points this year.

Do higher interest rates, on the other hand, imply a worse stock market?

The market, it turns out, tends to perform well during so-called rate-hike cycles, which we appear to be entering as early as March.

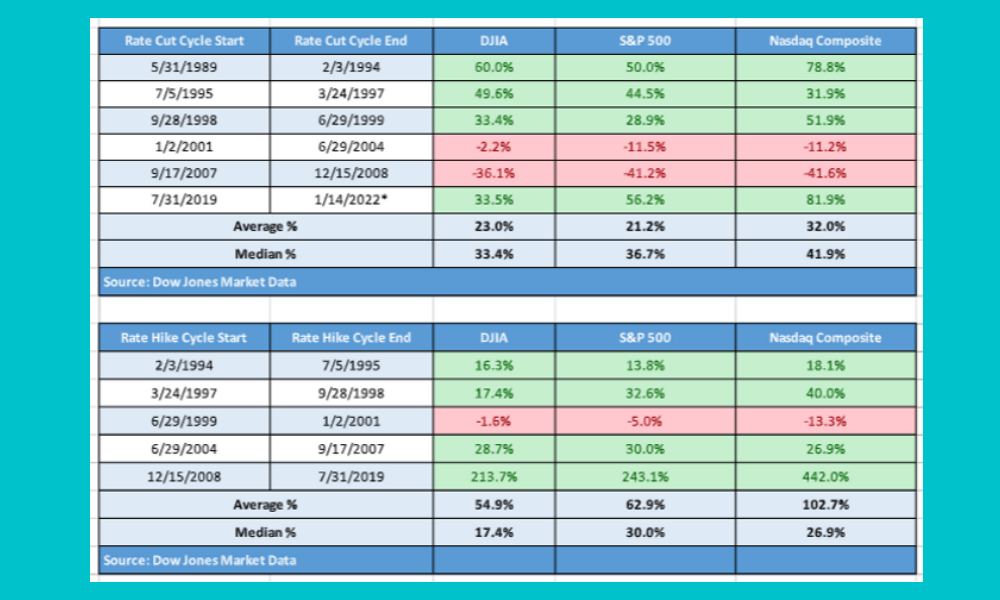

According to Dow Jones, the Dow Jones Industrial Average DJIA has averaged a good return of roughly 55 percent during Fed rate hike periods, while the S&P500 SPX has averaged a gain of 62.9 percent and the Nasdaq Composite COMP has averaged a positive return of 102.7 percent (see attached table). Fed interest rate reduction, perhaps unsurprisingly, result in large gains, with the Dow up 23%, the S&P500 up 21%, and the Nasdaq up 32% on average during a period of Fed rate drops.

Dow Jones Market Data

Interest rate reductions are more common when the economy is sluggish, whereas rate raises are more common when the economy is perceived as overly hot by some measures, which could explain the differential in stock market performance when interest rates are reduced.

To be honest, it's more difficult to imagine the market outperforming during a time of inflation reminiscent of the 1970s. Based on how markets have performed so far in 2022, it appears improbable that bullish investors will catch a whiff of double-digit returns. So far in January, the Dow is down 1.2 percent, the S&P 500 is down 2.2 percent, and the Nasdaq Composite is down a stunning 4.8 percent.

What's working for you?

Energy has been the winning stock market bet so far this year, with the S&P 500's energy sector XX: S&P 500 XLE up 16.4% so far in 2022, while financials XX: S&P500 XLF are a distant second, up 4.4 percent. The S&P 500's other nine sectors are either flat or down.

Meanwhile, value themes are making a stronger comeback, with the iShares S&P 500 Value ETF IVE posting a 0.1 percent weekly gain last week, but a 1.2 percent month-to-date return.

What exactly isn't working?

Bond yields have been hammering growth factors thus far because a quick rise in yields reduces the value of future cash flows. Higher interest rates also make it more difficult for technology businesses to fund stock buybacks. The popular iShares S&P 500 Growth ETF IVW is down 0.6 percent this week and 5.1 percent for the month of January.

Biotech stocks have taken a beating, with the iShares Biotechnology ETF IBB down 1.1 percent this week and 9% so far this month.

The SPDR S&P Retail ETF XRT, a popular retail-oriented ETF, fell 4.1 percent last week, contributing to a month-to-date fall of 7.4 percent.

Cathie Wood's flagship ARK Innovation ETF ARKK concluded the week down over 5%, putting the first two weeks of January at a 15.2 percent loss. ARK Genomic Revolution ETF ARKG and ARK Fintech Innovation ETF ARKF are two other funds in the complex that are similarly doomed.

Popular meme names are also taking a beating, with GameStop Corp. GME was down 17 percent last week and over 21 percent in January, and AMC Entertainment Holdings AMC was down almost 11 percent for the week and over 24 percent for the month.